Riyadh: An emerging platform for entrepreneurs

Riyadh, the capital and business center of Saudi Arabia, is emerging as the next global tech hub, driven by entrepreneurs from across the Kingdom and 40+ countries. This study, conducted by Endeavor and The Garage, sheds light on the motivations, impact, and experiences of Riyadh’s newly-arrived entrepreneurs.

Why entrepreneurs are moving to Riyadh?

1. Strong Consumer Base: 68% of entrepreneurs cited Riyadh’s large, affluent consumer market as the primary reason for relocating.

2. Connectivity to MENA: 36% highlighted the city’s strategic access to MENA markets, enabling expansion across the region.

3. First-Mover Advantage: 62% of Riyadh’s tech companies were founded in the last 5 years, offering high-growth potential in untapped industries.

Who’s Moving to Riyadh?

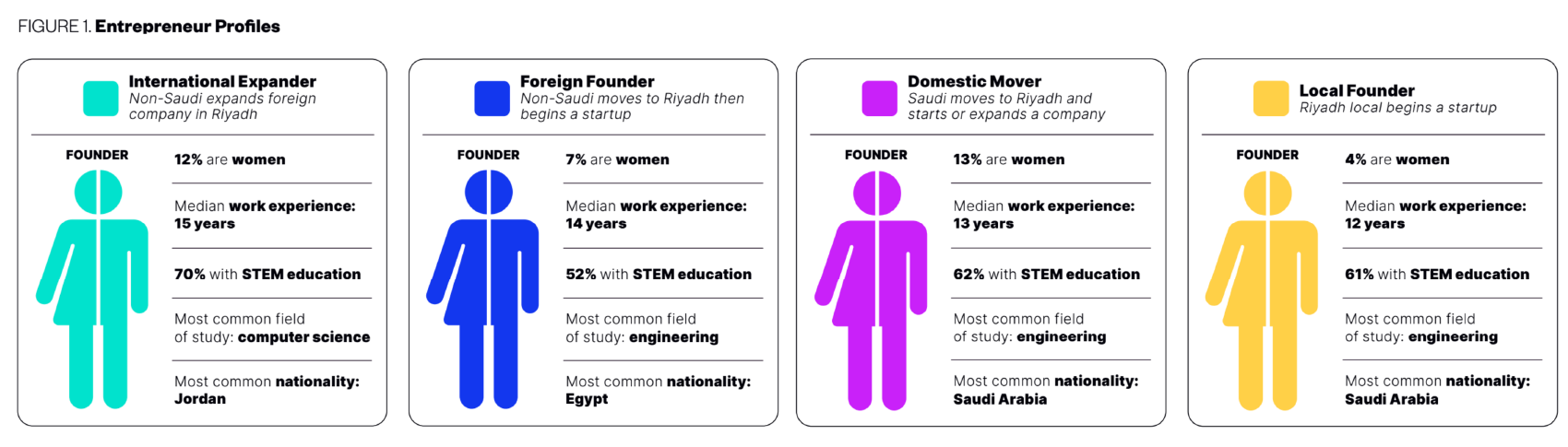

Entrepreneurs arrive through three main pathways:

- International Expanders: Non-Saudis bringing existing companies to Riyadh

- Foreign Founders: Non-Saudis launching new startups in the city

- Domestic Movers: Saudis relocating from other cities to build or scale ventures

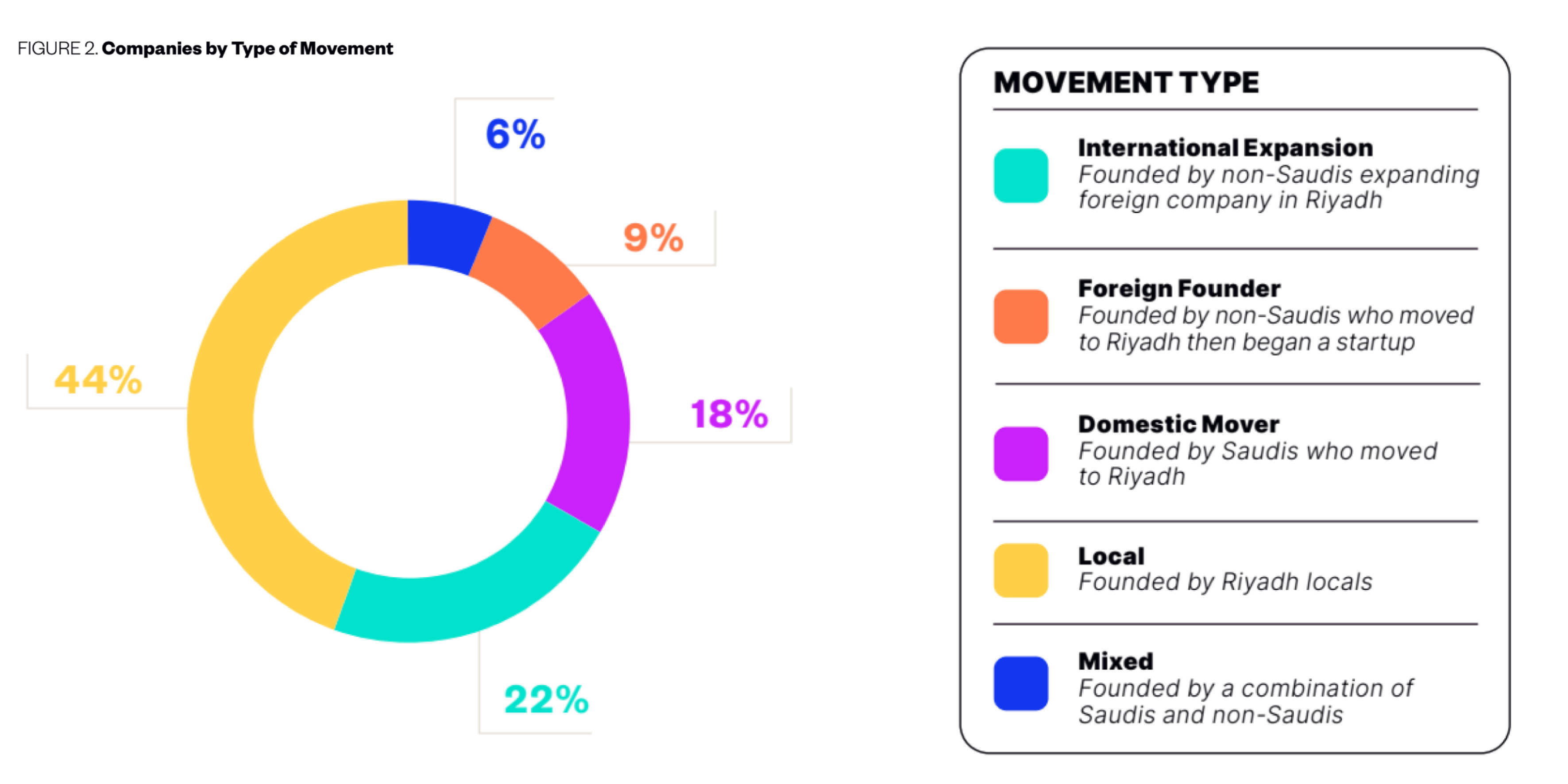

Today, moved and local founders each make up 50% of the tech ecosystem.

Why founders thrive in Riyadh?

1. A Unique Entrepreneurial Culture: Riyadh blends Saudi hospitality with the bold ambition of Vision 2030, creating an environment where innovation and tradition meet. 63% of non-Saudi founders highlight the local culture as a key benefit.

2. Direct Access to Customers: Being in Riyadh means being close to your market—whether B2C, B2B or B2G. 77% of founders say customer access is a major advantage.

3. Strong Ecosystem Connections: Riyadh’s public and private sectors actively support startups with mentorship, events, and infrastructure.

78% of moved entrepreneurs say ecosystem connections are a key benefit. 1 in 3 consider it the most valuable aspect of doing business in the city.

4. Access to Capital: Saudi Arabia is rich in early-stage capital, with 41% of moved entrepreneurs’ funding coming from local investors. 64% of founders see funding access as a strength, especially at Seed and Series A stages.